Our Founding Directors have in-house experience spanning decades in multiple disciplines, including corporate restructuring, strategic advice, M&A, fundraising, banking, and the turnaround of distressed projects and enterprises – all backed by solid credentials and a robust track record in the industry.

In addition to this, we have been active as accredited senior business rescue practitioners since the promulgation of Chapter 6 of the new Companies Act 2011, at the helm of many of South Africa’s largest business rescue cases, including the Business Rescue of Group Five, which won Metis the Gold Medal for Business Rescue Transaction of the Year at the annual DealMakers Awards in February 2022.

Metis’ service offering is executed through the Metis consulting team of c.20+ individuals from various disciplines and backgrounds.

Our team of Metis consultants provides an array of specialist skills and experience that meet our philosophy that restructuring is a complex business, requiring a multitude of competencies in its execution.

Thus, our Team consists of individuals with backgrounds in:

Strategy

Management

Accounting

Engineering

Law

Human Resources

Investment Banking

Corporate Banking

Turnarounds & Restructuring

Business Rescue

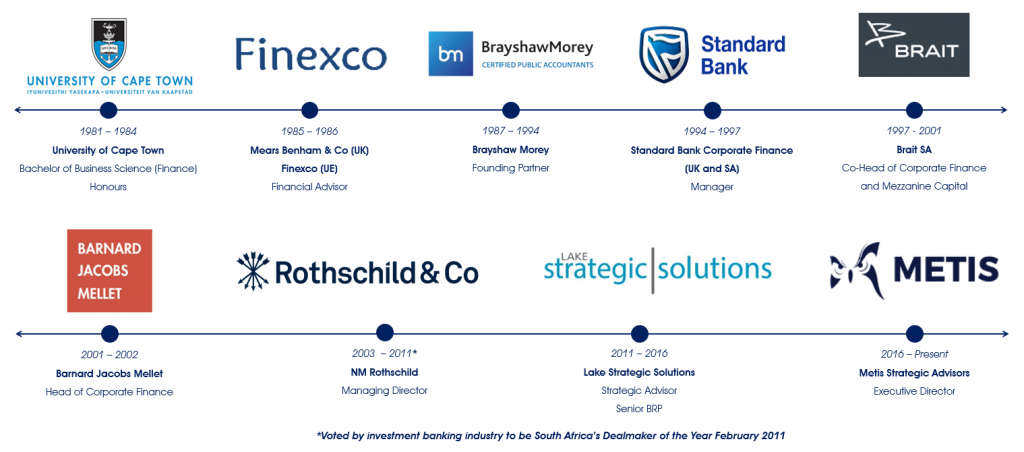

Formerly Managing Director with international investment bank NM Rothschild. Dave has over thirty years in the investment banking and financial services industry, twenty of those years in corporate finance advisory.

- Dave was formerly Managing Director with international investment bank NM Rothschild. Dave has over thirty years in the investment banking and financial services industry, twenty of those years in corporate finance advisory.

- Voted by investment banking industry to be South Africa’s Dealmaker of the Year in February 2011.

- Extensive record of corporate finance experience in strategy formulation, mergers, acquisitions, restructuring, capital raising, debt raising, debt restructuring, listings, valuation and project management.

- Led in strategy formulation assignments for numerous listed companies and in the formulation and execution of complex, cross border corporate restructurings and M&A transactions.

- Leader of the advisory teams on numerous landmark South African transactions, including: acquisition of controlling interests in Absa by Barclays, in Illovo Sugar by British Sugar, and in Massmart by Wal-Mart; listings of Massmart, Woolworths, Truworths, Mondi Packaging (MPact), and Brait; strategy formulation for Vodacom, Old Mutual and Illovo Sugar; restructurings for Brait and Wooltru (Woolworths, Truworths and Massmart).

- Completed Unisa course on Business Rescue Law, and licensed by the Companies and Intellectual Property Commission as a Senior Business Rescue Practitioner.

- Non-executive director of companies

- Advisor to the following companies: Wal-Mart, Associated British Foods, British Sugar, Illovo Sugar, ABSA, Standard Bank, Old Mutual, Mutual & Federal, Coronation, Vodacom, Wooltru, Woolworths, Gold One, Bond Exchange of South Africa, Transnet, Blue Financial Services, Tiso Capital, Brait SA, Capital Alliance, Imperial Holdings, African Harvest, Jasco, Unifer, Tradehold, Metorex, Ghanaian Government

- Chief restructuring Officer – Stefanutti Stocks

- Business Rescue Practitioner – Group Five

- Business Rescue Practitioner – Progress Milling

- Business Rescue Practitioner – Mintails Mining Group.

- Business Rescue Practitioner – Thata uBeke Manufacturing.

- Business Rescue Practitioner – Fontis Trading 200.

- Pre-business rescue assessment and strategy advice to a large South African industrial company (name withheld for confidentiality reasons).

- Advisor to Business Rescue Practitioners – Consolidated Infrastructure Group Limited

- Advisor to Business rescue Practitioners – Conco Group

- Advisor to the Business Rescue Practitioner and Board of Directors of Cuperex, a copper technology business in Business Rescue.

- Advisor to Board of Directors of Cuprachem, a copper mining/processing operation in Business Rescue.

- Advisor to 3 subsidiaries of a JSE listed company (confidential) considering business rescue proceedings.

- Advisor to JSE listed Vodacom on the potential restructuring and/or disposal of its financially distressed mobile telephone operations in the Democratic Republic of Congo.

- Advisor to JSE listed miner Gold One on a new fund raising and the negotiation/restructuring of its convertible bond liabilities.

- Advisor to micro-lender Blue Financial Services which found itself in significant “Financial Distress” with an unserviceable funding portfolio of billions of Rands owing to banks and development finance institutions.

- Advisor to Telkom Media on its technically insolvent situation.

- Advisor to ABSA controlled subsidiary and JSE listed micro-lending bank Unifer on its delisting, and recapitalisation subsequent to its multi billion Rand financial collapse.

- Advisor to Brait and Decillion on the restructuring and refinancing of Decillion subsequent to Decillion suffering significant trading losses.

- Advisor to Brait on the disposal of the financially distressed Brait Asset Managers.

- Advisor to Pinnacle Point on its debt restructuring transaction.

Trevor Murgatroyd (B.Com and LLB) has over 20 years’ corporate and investment banking experience. Appointed as General Manager in the Absa Capital Credit division in 1998, he was responsible for the credit risk of a diverse portfolio of clients before establishing the Workout & Recovery unit for Absa Capital in 2000.

- In 2005, Trevor assumed responsibility for the Workout & Recovery function for Absa Group’s Wholesale Banking (i.e. Absa Capital and Absa Corporate & Business Bank), where he was instrumental in many successful corporate restructurings on behalf of the Absa Group. Trevor was one of the quorum members for the Credit Committees of both Absa Capital and Absa Corporate & Business Bank and frequently chaired these meetings.

- In 2008, Trevor left the banking industry to pursue a career in the business recovery, turnaround, and workout industry, successfully designing, negotiating, and implementing many workouts and turnarounds since then. TM Restructuring is based on this solid and successful track record.

- In 2016 Trevor teamed up with two like-minded restructuring and senior business rescue specialists to create more capacity and broader skills base and co-founded Metis Strategic Advisors.

- Trevor was a Working Group Member for the launch of the South African Chapter of the Turnaround Management Association, where he served on the Board from 2008 to 2010 and continues as a member. He was also a member of the banking industry task group, which contributed to the Business Rescue legislation contained in the Companies Act of 2008.

- Trevor is a Licensed and Accredited Senior Business Rescue Practitioner.

Trevor has successfully designed, negotiated, and implemented a number of transactions, some of the more prominent engagements include:

- Engaged by Absa Capital with the negotiation of settlements and refinancing packages with respect to large Single Stock Future positions some of which defaulted;

- Negotiated a settlement to a dispute with the Government of the Republic of Zambia (“GRZ”) and implementation of the settlement agreement;

- Advisory role with regard to the recapitalisation of a listed company, including restructuring of banking arrangements and an underwritten rights issue and participating in banking consortium;

- Negotiated and implemented an informal business rescue for one of the largest privately-owned alluvial diamond miners; and

- Assisted manufacturing and distribution of plastic pipe systems, fittings, and flexible hoses company in one of the first offers of compromise with creditors pursuant to Section 155 of the Companies Act.

- Advisor to a party seeking to acquire a construction business through business rescue, but avoided business rescue and successful acquisition resulted.

- Advised a bidder regarding an offer to acquire On Digital Media’s Top TV whilst in business rescue.

- Advisor to one of the shareholders regarding their interests in a restructuring of Peermont.

- On behalf of a purchaser, facilitated the acquisition of a hotel property together with the claims of the lenders.

- Advisor to retail franchise group regarding their turnaround and restructuring of banking facilities.

- Advisor to one of the largest suppliers to Ellerines regarding their position, claims, and reservation of title during business rescue proceedings of Ellerines.

- Advisor to a transporter for a Ferrochrome and Chromite mining operation regarding their claims, resulting in a successful exit.

- Advisor to a company engaged in gold mining and exploration project in order to avoid business rescue proceedings.

- Advisor to the board of a large mining and metals commodities firm considering strategic turnaround and restructuring options including potential business rescue proceedings.

- Business Rescue Advisor to Group Five Ltd and Group Five Construction (Pty) Ltd.

- Restructuring Advisor to Stefanutti Stocks.

- Restructuring Advisor and Business Rescue Advisor to Consolidated Infrastructure Group Ltd and Consolidated Power Projects (Pty) Ltd.

- Restructuring Advisor to a large listed construction company.

- Trevor has performed the role of Senior Business Rescue Practitioner (“BRP”) for the following matters:

- Mpumalanga Petroleum – marketing and distribution of petroleum.

- Eurocelt Durban – a manufacturer of plastic water and sewer pipe systems from polypropylene and HDPE.

- Creditworx – collections company.

- Sanyati Holdings and Sanyati Civil Engineering and Construction (“SCEC”) – a civil engineering and construction business.

- Thuthuka Group Ltd (“TGL”) – a multi-disciplinary engineering company, which included chemical and metallurgical process, water and effluent treatment, hazardous waste and air pollution control as well as the construction of the civil infrastructure for these plants.

- Joint BRP for three companies in the same group:

- Continental Coal Ltd (South Africa), an investment holding company with investments in mining and exploration and related activities;

- Mashala Resources (Pty) Ltd, operated in mining of coal and lignite, exploration and marketing of coal resources and has investments in other mining and exploration interests; and

- Penumbra Coal Mining (Pty) Ltd a coal mining operation in the Ermelo area.

- Joint BRP for Kudumane Manganese Resources (Pty) Ltd (“KMR”), a manganese mining company.

- Derry Engineering (Pty) Ltd – manufacturer of valve gear and other components for drilling equipment for the mining sector.

- International Ferro Metals (SA) – producer of ferrochrome from the chromite ore located in the Bushveld Igneous complex, comprising a chromite mine and integrated beneficiation and smelting operations.

- Joint BRP for Rockwell Resources RSA (Pty) Ltd/HC van Wyk Diamonds Ltd/Saxendrift Mine (Pty) Ltd – Subsidiaries of Canadian Stock Exchange listed entity operating in alluvial diamond mining industry.

- Joint BRP or Hernic Ferro Chrome (Pty) Ltd – Producer of ferrochrome from chromite ore located on the western limb of the Bushveld Complex in South Africa. Hernic mines produce and sell ferrochrome.

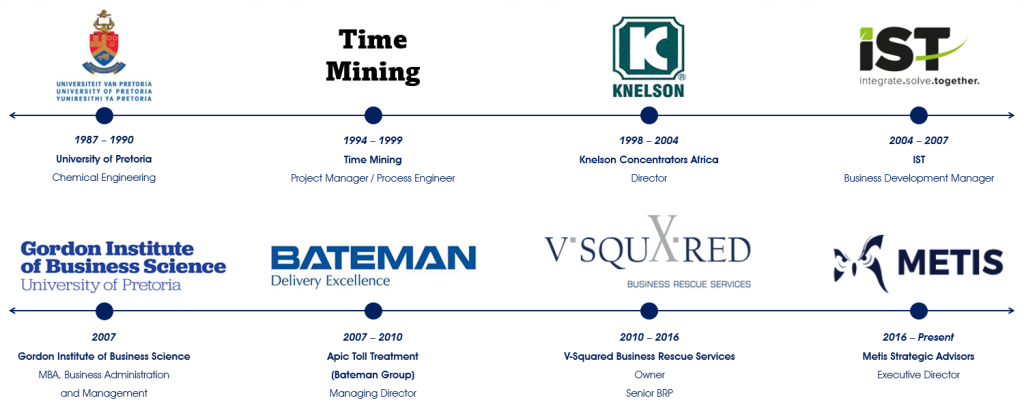

Peter has a true passion for turnarounds and restructuring. He is a licensed and accredited Senior Business Rescue Practitioner.

- Chemical/Process Engineer and project manager, Turnaround Specialist, Licensed and Accredited Senior Business Rescue Practitioner.

- Before committing his career full-time to the business rescue and turnaround space, Peter worked in production, design, project management, technology development and commercialization and business development in the minerals and mining environment.

- Exposure to turnarounds already from the early stages of his career.

- Solid experience in the publicly listed and unlisted environments with international investors, note holders, shareholders, lenders, and regulators/administrators within the Business Rescue context. China, Australia, Canada, USA, UK, Switzerland.

Business Rescue

Joint BRP Consolidated Infrastructure Group (JSE)

Joint BRP Consolidated Power Projects (“ConCo”)

Joint BRP Group Five Limited (JSE)

Joint BRP Group Five Construction

Joint BRP Hernic Ferrochrome

BRP – DRD’s (JSE and NYSE) Blyvooruitzicht Gold Mine

BRP – Great Basin Gold’s (TSX and JSE) Southgold Exploration

BRP – On Digital Media’s Top TV

BRP – Seemann’s Meats

Joint BRP – Endulwini Coal Limited

Joint BRP – Continental Coal’s (ASX) and subsidiaries

BRP – Marlin Group of Granite Quarries

Joint BRP – Kudumane Manganese Resources

Joint BRP – Glencore’s Optimum Coal Holdings and Optimum Coal Mine

Informal turnaround, restructuring, and advisory projects

Restructuring advisor to 2 large publicly listed construction companies in SA

Turnaround of 2 diamond tailings re-treatment facilities in SA (optical sorting)

Turnaround of 3 gravity gold recovery projects in SA

Turnaround of a North American subsidiary in SA – part of the biggest optical sorting company in the bottling industry worldwide.

Restructuring Advisor to funders in a large independent power producer.

Turnaround/restructuring advisor to the board of First Uranium and Simmer and Jack Mines.Turnaround and disposal of the Bateman Mineral Recovery international group of companies – part of the Bateman BV group. Interests in SA, Poland, Romania, Turkey, Georgia, Finland, Sweden, USA, and Brazil.

Advisor to the board of large ferroalloy smelting operation in SA including a pre-assessment prior to its filing for business rescue proceedings.

Strategic Advisor to a consortium of investors for the successful take-over of a group of companies in business rescue in the Agri commodities industry.

Advisor to the board of large international mining and metals commodities firm considering strategic turnaround and restructuring options including potential business rescue proceedings.

BR/Restructuring/turnaround work for and with a variety of corporates, large international banks, and DFIs in industries such as mining, technology, energy, media, and food.

Cross-cultural business dealings and negotiation experience: Botswana, Zimbabwe, Zambia, Russia, India, China, Israel, Germany, Poland, Georgia, Finland, Sweden, UK, Netherlands, Switzerland, USA, Canada, Australia.

Gavin is an operational turnaround specialist and director of Metis Isle of Man. Formerly a country Managing Director Gavin has 27 years of experience and in-depth knowledge having lived and worked in multiple countries and regions across Africa. His work in turnarounds has primarily been business units for multi-national corporations such as SABMiller and Carlsberg focusing on growth, crisis management, green and brownfield development, and business transformation. He has experience covering Medical tech, FMCG, beverages, retail, and agribusiness. His core strengths include setting strategy, building diverse multi-cultural leadership teams, overcoming country-specific challenges in regulations, logistics, and foreign currency constraints whilst developing strong Board and Investor relations and leading constructive interactions with regulatory authorities.)

After graduating from Rhodes with a B.Com Honours in Accounting, Economics and Auditing, Martin moved to London, where he excelled in various disciplines within the banking industry, at BNY Mellon and JP Morgan. He was transferred back to South Africa and joined JP Morgan Investment Bank (South Africa) in 2013 and in 2015 he left banking for Cuperex, where he developed a passion for business turnaround and rescue. Martin is a licenced and accredited Business Rescue Practitioner and is currently one of the jointly-appointed practitioners on the Consolidated Infrastructure Group and Consolidated Power Projects business rescues.

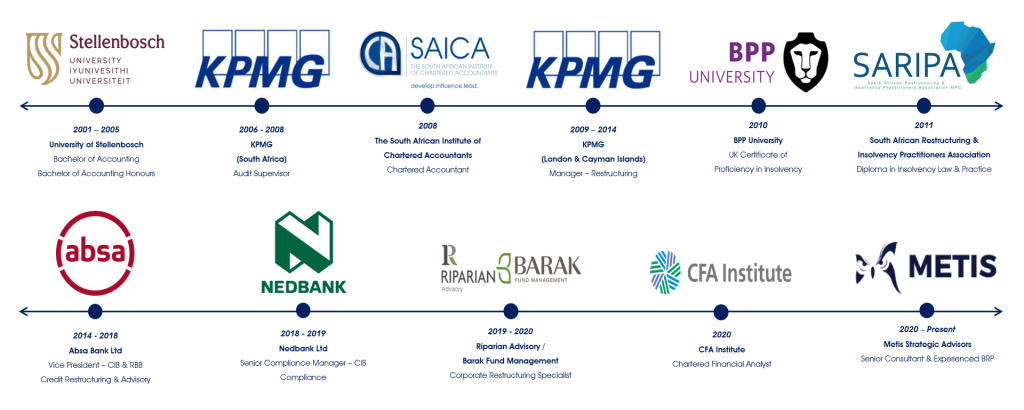

Gerhard is a passionate and motivated CA(SA), CFA Charter Holder and Business Rescue Practitioner. He has extensive experience in auditing, banking, business rescue, corporate restructuring and turnarounds. After completing his articles, Gerhard worked in an international big-4 practice where he developed his passion for corporate restructuring. He also has extensive Africa experience having spent time abroad as a workout professional in banks and alternate financiers. Gerhard is currently one of the jointly-appointed practitioners on the Tongaat Hulett business rescues.

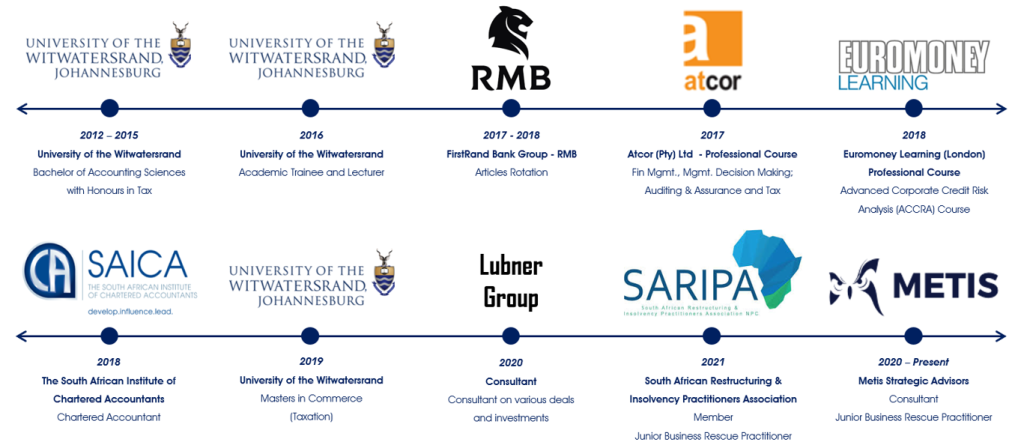

Ashleigh is a passionate and dedicated CA(SA) and Business Rescue Practitioner. After completing her BaAccSci (Hons) (Tax) at WITS, she was chosen to be an

Academic Trainee at the university in 2016, where she taught Financial Accounting III. Ashleigh completed her remaining two years of Articles at the FirstRand Bank Group, predominantly in RMB. While completing her articles, she completed her Masters in Commerce, where she specialised in International Tax. Ashleigh then consulted on a number of deals and investments for the Lubner Group, before joining Metis in early 2020. Ashleigh has an incredible ability to contextualise and communicate information and will persist in her desire to make sense of complex concepts. Ashleigh has a passion for problem-solving and strives to challenge herself in the quest for continuous learning and upskilling, as is required in her role.

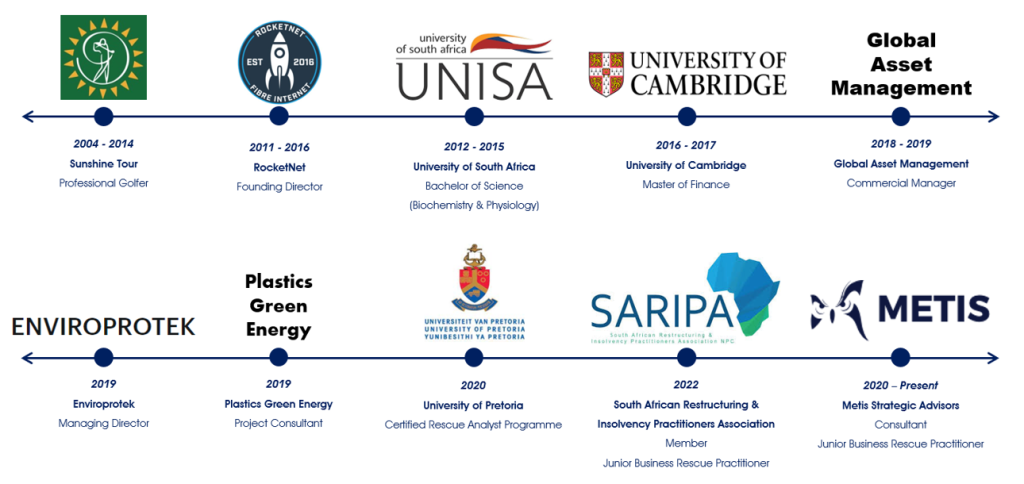

In his younger years, Josh competed as a professional golfer both locally and abroad. In his transition from professional sports, Josh received a Bachelor of Science degree from UNISA and then a Master of Finance degree from the University of Cambridge (UK). Josh is an entrepreneurial thinker with broad, senior-level experience across a range of industries, from telecommunications to heavy industry, in both business-to-business and consumer-facing sectors. He is passionate about business turnarounds and excels in the management and implementation of project management strategies. Josh joined the Metis team in 2020 and is a licensed Business Rescue Practitioner.